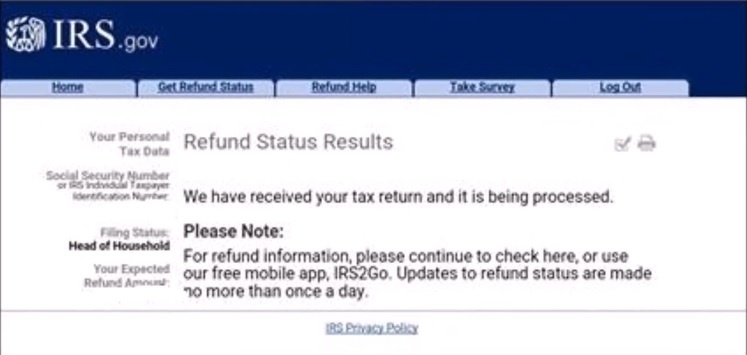

If this is the case, you may be able to change or correct your address online using Where's My Refund?. Notice that the IRS could not deliver your refund due to an incorrect address.The mailing date or direct deposit date of your refund or.Acknowledgement that your return was received and is in processing.Once you enter your personal information, you could get several responses from the online response system, including: If you filed a joint income tax return, you can use either your Social Security Number or your spouse's Social Security Number The exact whole dollar refund amount shown on your tax return.Your filing status-Single, Married Filing Joint Return, Married Filing Separate Return, Head of Household, or Qualifying Widow(er) and.Your Social Security Number or Individual Taxpayer Identification Number.Here are the items you will need to enter in order to receive your status report: When checking the status of your refund, make sure you have your federal tax return handy, because you will need some specific information from the return in order to get your personalized refund information. If you filed a paper return, refund information will generally be available three to four weeks after mailing your return. If you e-filed your federal income tax return, you can get information about the status of your refund 72 hours after the IRS acknowledges receipt of your return. savings bonds or asked the IRS to mail you a check, Where's My Refund? give you online access to your refund information nearly 24 hours a day, 7 days a week. Whether you split your refund among several accounts, opted for direct deposit into one account, used part of your refund to buy U.S.

This is the fastest, easiest way to get information about your federal income tax refund. Online access to refund information can be found at Where's My Refund? or Donde esta mi reembolso?, the interactive tools on the IRS website. The IRS understands this anxiety, and has provided several ways to check the status of your tax refund. It's not unusual to get a bit anxious as you wait for the refund after filing the return. If you filed electronically, your refund will normally be issued within three weeks after the acknowledgment date. For forms and publications, visit the Forms and Publications search tool.Are you expecting a tax refund from the Internal Revenue Service (IRS) this year? If you file a complete and accurate paper tax return, your refund will usually be issued within six to eight weeks from the date it is received. We cannot guarantee the accuracy of this translation and shall not be liable for any inaccurate information or changes in the page layout resulting from the translation application tool.įorms, publications, and all applications, such as your MyFTB account, cannot be translated using this Google™ translation application tool. For a complete listing of the FTB’s official Spanish pages, visit La esta pagina en Espanol (Spanish home page). These pages do not include the Google™ translation application. We translate some pages on the FTB website into Spanish. If you have any questions related to the information contained in the translation, refer to the English version. Any differences created in the translation are not binding on the FTB and have no legal effect for compliance or enforcement purposes. The web pages currently in English on the FTB website are the official and accurate source for tax information and services we provide.

Consult with a translator for official business. This Google™ translation feature, provided on the Franchise Tax Board (FTB) website, is for general information only.

0 kommentar(er)

0 kommentar(er)